Are you finding it difficult to get a regular credit card because of the strict requirements? This situation can be a roadblock if you’re trying to build a good credit history since having a credit card is key to that process. If this sounds like you, don’t worry. There’s a great option available: secured credit cards.

These are an excellent option for people with limited credit history or income to start their journey towards financial freedom. We will discuss secured credit cards, their benefits, and how they can help you build a stronger credit foundation. We’ll also compare them with other types of cards to give you a better idea if this tool is the right one for you.

What are Secured Credit Cards?

A secured credit card is a financial tool designed for people who want to build or improve their credit score. Unlike regular credit cards, which we will refer to as unsecured credit cards, you need to deposit money upfront when you get a secured credit card. This money acts as a safety net for the bank, in case you can’t pay your bill. The amount of money you deposit usually sets your credit limit. So, if you deposit $500, you’ll have a $500 limit on your card.

How Secured Credit Cards Work

This card allows you to establish or rebuild your credit history, regardless of your current credit score. Since most banks don’t perform a traditional credit check if you apply for this type of product, you can obtain a secured credit card even with a low credit score. This means you can begin proving your financial responsibility and access necessary goods or services via credit. As you consistently manage your secured credit card responsibly, you’ll steadily improve your credit score, opening doors to further financial opportunities.

Reasons for Getting a Secured Credit Card

Below are several compelling reasons why individuals may choose to apply for a secured credit card.

- Credit Building or Repair: Secured credit cards can be an accessible way to build or improve credit. Lenders are more willing to issue these cards to individuals with risky or limited credit profiles.

- Easier Approval: Secured credit cards have more lenient approval requirements compared to traditional unsecured cards. They are more accessible to individuals with limited credit history or poor credit scores.

- Encouraging Financial Discipline: The security deposit serves as forced savings since it’s an amount the cardholder cannot access until the account is either closed or upgraded to an unsecured card. This setup promotes financial discipline and encourages responsible spending and saving habits.

- Spending Control: The credit limit on a secured card is typically tied to the amount of the security deposit, allowing individuals to control their spending and gradually increase their credit limit by depositing more funds.

- Enables Transition to Unsecured Cards: The regular, responsible use of a secured credit card can lead to an improved credit score. This may allow the cardholder to qualify for an unsecured credit card with better terms and benefits. Some issuers might even offer to upgrade the card to an unsecured version after a period of positive credit behavior.

- Potential for Rewards and Benefits: While less common, some secured credit cards offer rewards or benefits similar to unsecured cards, such as cash back on purchases, fraud protection, and free credit score access.

Secured vs. Unsecured Credit Cards

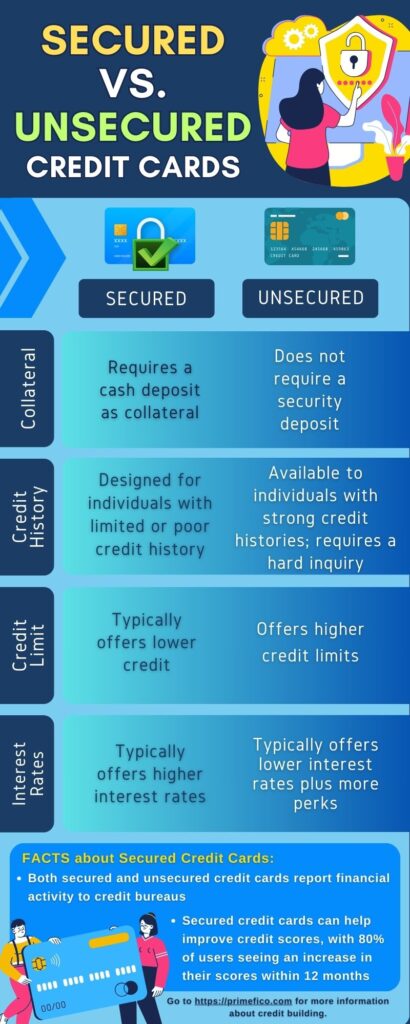

The primary difference between secured and unsecured credit cards lies in the security deposit. The former requires one, which minimizes risk for the issuer and allows individuals with no credit or poor credit to get a card. As long as you can provide the collateral, most banks readily approve applications for secured credit cards. This is not true for unsecured credit cards, where you will need to satisfy more stringent criteria to qualify.

In most cases, secured credit cards come with higher interest rates, lower credit limits, and fewer rewards or perks. However, both types of cards report to credit bureaus, so using a secured credit card still contributes to your financial growth.

Secured vs. Prepaid Cards

Both prepaid cards and secured credit cards require you to deposit money upfront before you can use them, which might make them appear similar at first glance. However, they function quite differently in terms of managing your money and affecting your credit.

For secured credit cards, your deposit acts as a security for the bank, meaning you’re essentially borrowing money and will still need to repay. The security deposit serves as a safeguard in case you fail to pay what you owe. The primary advantage of secured credit cards is their capacity to aid in building or repairing your credit score, as banks report your payment behavior to credit bureaus.

On the contrary, prepaid cards are simpler. You load them with money and use the funds until depleted, similar to a gift card. Since the money is not borrowed but your own, prepaid cards do not involve credit. Thus, activities on prepaid cards are not reported to credit bureaus, meaning they won’t affect your credit score.

Who Should Consider Getting a Secured Credit Card?

These cards are particularly beneficial for individuals in specific financial situations or with particular credit goals. Here are some groups of people who might consider getting a secured credit card:

-

-

Students and Young Borrowers:

Students or young people who are just starting out and want to establish credit might find these cards to be an accessible option. These cards can serve as a stepping stone to unsecured cards with better benefits.

-

Those with Limited Credit History:

Individuals who are new to credit, such as young adults, recent immigrants, or anyone who has never used credit before, can use secured credit cards to start building a credit history.

-

People with Bad Credit:

For those who have made financial mistakes in the past leading to poor credit scores, secured credit cards offer a chance to rebuild credit. By making timely payments and keeping balances low, users can improve their credit scores over time.

-

People Looking to Improve Credit Scores:

Even if you have an average credit score, a secured credit card can help you boost it. Responsible use of a secured card can demonstrate to lenders that you’re a low-risk borrower, potentially leading to an improved credit score.

-

Individuals Denied Unsecured Credit Cards:

If you’ve been denied an unsecured credit card for any reason, a secured card can be a viable alternative.

-

People Seeking to Establish Financial Discipline:

Secured credit cards often come with lower credit limits, which can help users practice managing credit without the temptation to overspend. This can be a valuable tool for learning financial discipline.

-

It’s important for anyone considering a secured credit card to understand how these cards work. The required deposit typically determines the credit limit, and unlike prepaid cards, secured credit cards report payment activity to credit bureaus. It can boost or bring down your credit score depending on your use.

Pros of Getting a Secured Credit Card

Secured credit cards are often recommended as a powerful tool for building or rebuilding credit. They function by requiring a cash deposit that serves as collateral for the credit limit, making them a less risky option for lenders and an accessible credit-building tool for consumers.

Credit Building Opportunities

These cards are an excellent tool for building or rebuilding credit. By making timely payments and keeping balances low, cardholders can improve their credit scores over time. This is because issuers report payment history to the major credit bureaus.

Accessibility for New Users

For individuals with limited credit history or low credit scores, secured credit cards offer a feasible way to access credit. The required deposit lowers the risk for issuers, making approval more likely than for traditional credit cards.

Improved Financial Habits

Using this type of card responsibly can encourage good financial habits. It teaches the importance of making payments on time and managing credit wisely, skills that are beneficial for all types of credit usage.

Security Features and Fraud Protection

Like traditional credit cards, secured cards offer fraud protection. Cardholders are not held responsible for unauthorized transactions, providing a layer of security against credit card fraud.

Cons of Secured Credit Cards

Initial Deposit Requirement

The need for an upfront deposit can be a barrier for some individuals. This deposit is typically equal to the credit limit and can range from a few hundred to several thousand dollars.

Lower Credit Limits

Secured credit cards often come with lower credit limits compared to unsecured cards. While this can help prevent overspending, it may also limit purchasing power.

Fees and Interest Rates

These may have higher fees and interest rates than some unsecured cards. It’s important to read the terms carefully and understand all associated costs.

Potential for Misuse

As with any credit card, there’s a risk of overspending and accruing debt. Responsible use is crucial to avoid falling into a debt trap and damaging your credit score further.

In the next section, we’ll guide you through applying for a secured credit card. From understanding eligibility requirements to selecting the right card and navigating the application process, this comprehensive overview prepares you to take the next steps confidently in your credit-building journey.