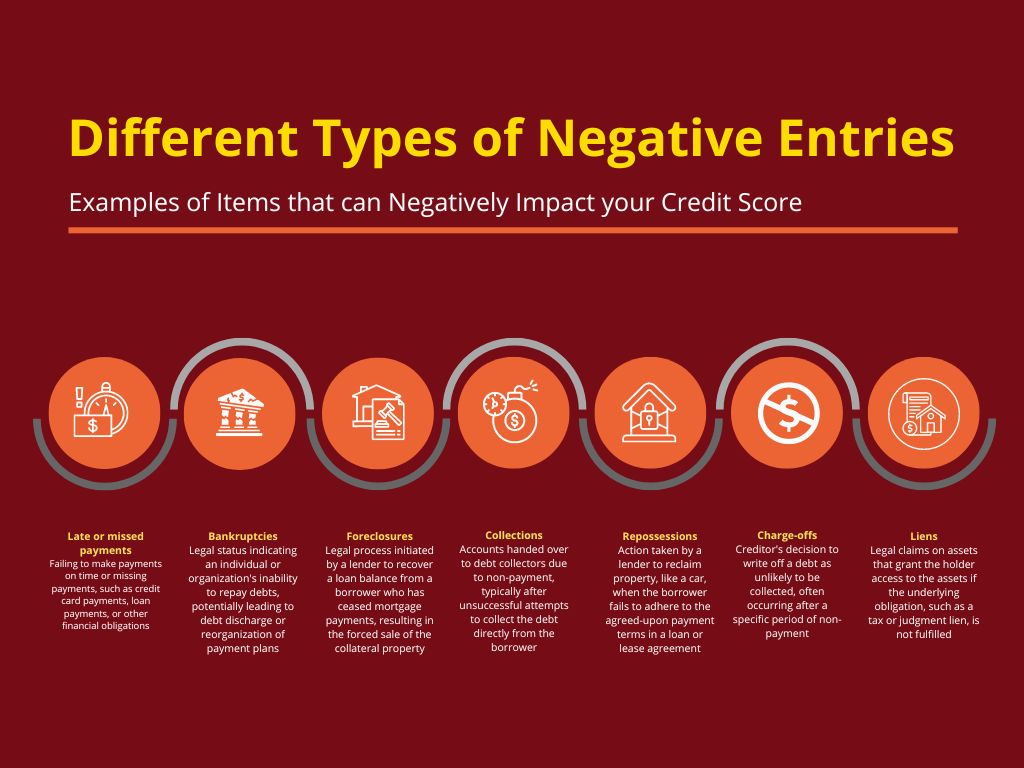

Negative entries are items in your credit report that can pull down your credit score. Resolving these negative entries is an essential step in your path to better credit. In this chapter, we’ll learn about the different types of negative marks and how they can impact your credit. We’ll also discuss some tips to help you in overcoming these obstacles to your credit repair success.

Late Payments: How They Affect Your Credit

Late payments are the bane to your credit score. A single late payment can cause your score to drop drastically. If you pay beyond the deadline by thirty days or more, you may lose up to 100 points. The actual number of points deducted varies depending on factors like how high your existing score is and what other negative entries you have on your report.

Here’s how late payments affect your credit:

- Credit Score Impact: Late payments can stay on your credit report for up to seven years, affecting your credit score during that time.

- Severity Matters: A 90-day late payment has a bigger impact than a 30-day late payment. The negative impact increases with the severity of the delinquency.

- Recent Late Payments: Recent late payments have a more substantial impact than older ones. This emphasizes the importance of paying on time.

Collections and Charge-Offs: Steps to Resolve Them

Collections and charge-offs occur when a creditor gives up trying to collect a debt. This means that your account will either be written off as a loss or get sold to a collection agency. Your credit profile may suffer as a result of these entries.

Steps to resolve collections and charge-offs:

- Verify the Debt: Request for a validation of the debt from the collection agency. They must provide proof that the debt is indeed yours.

- Negotiate a Settlement: If the debt is valid, negotiate a payment arrangement or settlement with the collection agency. Ensure that any agreement is in writing.

- Pay for Deletion: Work out a deal with the collection agency to remove the negative entry from your credit report in exchange for payment. Make sure to get this agreement in writing before making any payments.

Bankruptcies and Foreclosures: Recovering Over Time

Bankruptcies and foreclosures are severe negative entries that can remain on your credit report for up to 10 years. Don’t lose hope. Getting these strikes doesn’t mean your credit history is ruined forever.

- Bankruptcies: Chapter 7 and Chapter 13 bankruptcies can stay on your report for up to ten years. The impact diminishes with time, particularly if you demonstrate responsible financial behavior.

- Foreclosures: A foreclosure can remain on your report for up to seven years. As with bankruptcies, its impact diminishes with time and effective credit building.

Rebuilding After Negative Entries

Recovering from negative entries takes time, dedication, and strategic effort:

- Prioritize On-Time Payments: Making regular, on-time payments is one of the best things you can do to repair your record. This demonstrates responsible credit behavior.

- Apply for New Credit Wisely: Gradually open new credit accounts to rebuild your credit. Remember that your score can be pulled down if you open too many new accounts within a short period. Be cautious not to overextend yourself.

- Credit Counseling: Learn how to properly manage your finances by seeking professional credit counseling. A financial advisor can help you establish a plan to rebuild your credit.

- Patience and Persistence: Remember that time is on your side. The impact of negative entries on your credit lessens as they age.

- Regularly Monitor Your Credit: Keep an eye out for any errors or new negative entries on your credit report.

Addressing negative entries on your credit report takes perseverance and a focus on positive credit practices. You’ll eventually clear the path to a better financial future by being aware of the effects of negative entries and taking proactive steps to resolve and rebuild.

In the next chapter, we will go into the methods of managing and reducing your debt load. You’ll learn important tips for managing your debt such as creating a repayment plan and negotiating with creditors.

Next: Chapter 8: Debt Management Techniques, where we’ll review different strategies to regain control of your finances and work towards a more secure financial footing. As you start using these methods, you’ll be making meaningful progress on your credit repair journey.