Understanding the Importance of Credit and The Role of Credit Scores and Reports

Very few things are as important as your credit when it comes to financial well-being. Credit is tied to many crucial decisions. Whether you’re trying to buy a car, secure a mortgage, lease a business space, or even apply for a credit card, maintaining a positive credit history and credit score is not only instrumental in determining your eligibility but also in dictating the terms you will receive.

In this introductory guide to credit repair, we will look into why credit matters and what the key players in the credit landscape are – credit scores and credit reports.

Understanding the Importance of Credit

Lenders, landlords, and even some potential employers may view your credit as your financial report card. They can use this document to evaluate your financial responsibility. While it may not paint the entire picture, your credit can offer a snapshot of how you manage your finances, particularly your borrowing and repayment habits.

Maintaining good credit is important because it can have a direct impact on your access to certain financial opportunities.

- Access to Loans and Credit: Lenders use your credit to assess the risk of lending you money. A strong credit history can make you eligible for loans and credit cards.

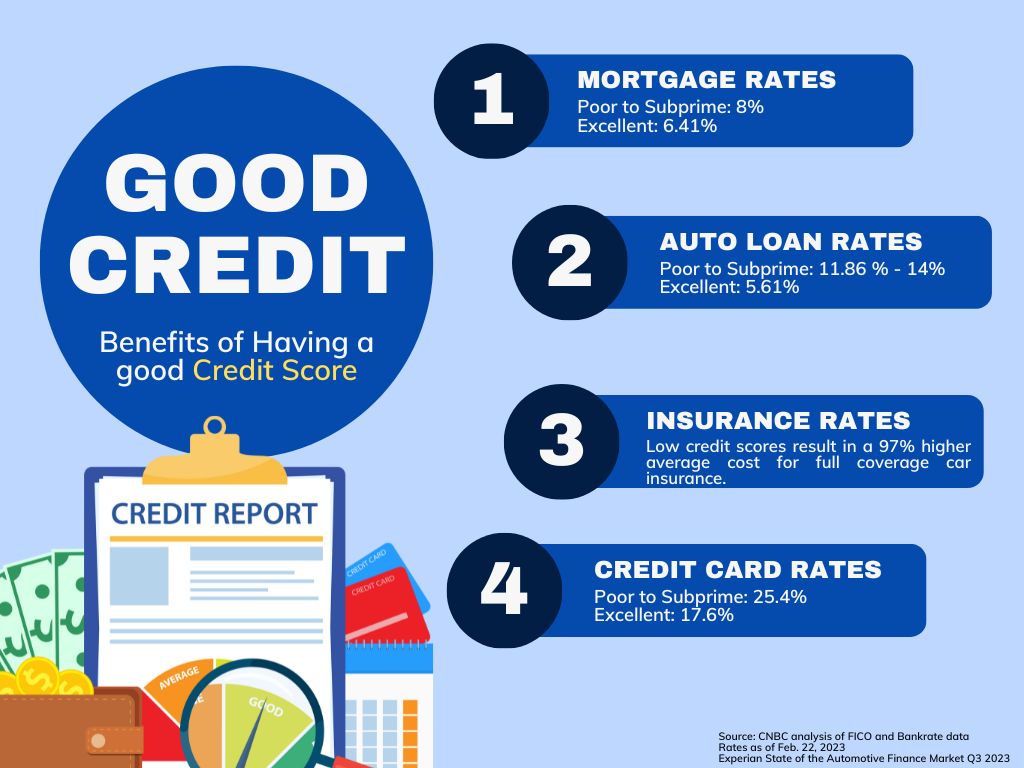

- Better Interest Rates: Individuals with high credit scores may be offered lower interest rates because they are less likely to default on their loans. Lower interest rates mean you’ll be paying less interest over time, thus potentially saving you thousands of dollars.

- Lower Insurance Premiums: Your credit can influence your insurance premiums. Those with higher credit scores might qualify for lower auto or homeowner’s insurance rates.

- Employment Opportunities: Some employers may check your credit report during the hiring process, especially if you are applying for a position that involves financial responsibilities. Your credit behavior can reflect positively on your overall reliability.

- Easier Rental Approval: Some landlords may check your credit when deciding to rent you a space. A positive credit history signals that you are likely to pay rent on time, potentially making the approval process smoother.

The Role of Credit Scores and Reports

An individual’s financial profile can be better understood by looking at his credit score and credit reports. The credit report serves as a detailed ledger of one’s financial journey while the credit score summarizes all that into one numerical representation. Together, these give lenders and creditors a clear picture of how you handle your money. Your credit reports and scores serve to aid lenders in making informed decisions about your legibility for loans, credit cards, and other financial opportunities.

Credit Report: This report is a record of an individual’s credit history. It includes your open and closed credit accounts, payment history, and outstanding balances. It also details any negative marks like late payments or collections.

Three major reporting agencies maintain their version of your credit reports. These are Equifax, Experian, and TransUnion.

Credit Score: Your credit score is the single number that represents all of the information in your credit report. It makes assessing your creditworthiness much easier, condensing your financial details into a straightforward metric. This numerical summary enables lenders to easily gauge your financial health, helping them quickly evaluate the risk associated with extending credit to you.

The most common credit scoring models are FICO and VantageScore. These scores take into account factors such as payment history, credit utilization, length of credit history, types of credit, and recent inquiries.

In the next chapters, we’ll look into each of these aspects in greater detail. We will help you understand how credit scores are calculated to learn how to read your credit report. This guide will also equip you with the knowledge and tools you need to navigate the world of credit repair.

Remember, improving your credit is not an overnight process. It takes time, effort, and a commitment to responsible financial habits. So, let’s dive in and uncover the strategies that can help you take control of your credit journey and achieve the financial future you deserve.

Next: Chapter 1: Decoding Credit Scores, where we’ll unravel the mysteries behind credit scores and their impact on your financial life.