Believe it or not, having debts is not all bad. If you take that debt and use it to generate income then it’s quite a good financial strategy. The key is knowing proper debt management to keep it from affecting your credit health negatively.

Managing and reducing your debt is a crucial part of credit repair. In this chapter, we’ll explore effective strategies to help you regain control of your finances. We will cover tips on how to negotiate with creditors and explore alternatives to high-interest debt. By using these techniques, you can improve your credit health and achieve your financial goals despite having debts.

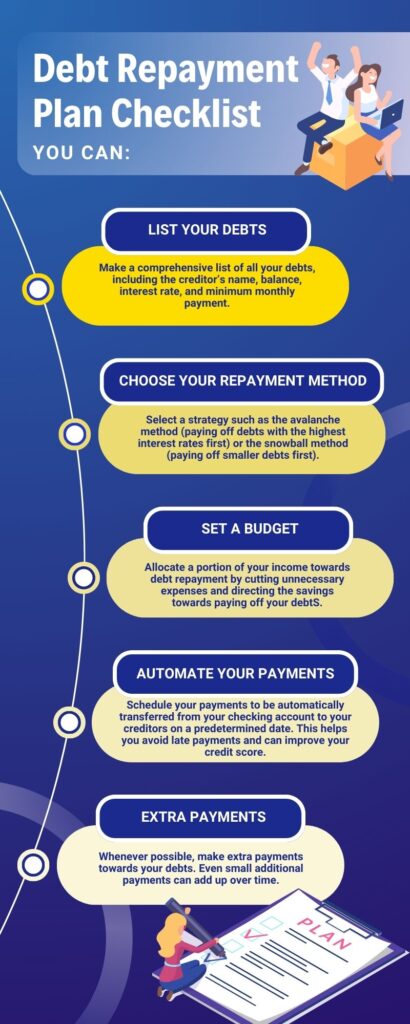

Creating a Debt Repayment Plan

Having a well-structured debt repayment plan is essential. It provides clarity and direction as you work towards paying off the money you owe. Here’s how to create a solid debt repayment plan:

- List Your Debts: Make a comprehensive list of all your debts. Include in this list your creditor’s name, balance, interest rate, and minimum monthly payment.

- Prioritize High-Interest Debts: If you can, focus on paying off high-interest debts first. These are the debts that cost you the most in interest over time.

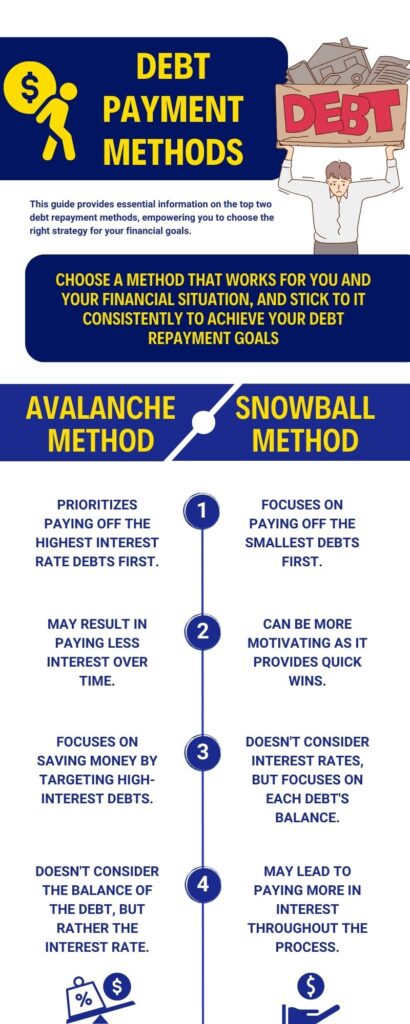

- Snowball vs. Avalanche Method: Choose between the snowball method (paying off smaller debts first) or the avalanche method (paying off debts with the highest interest rates first).

- Set a Budget: Create a realistic budget that allocates a portion of your income towards debt repayment. Get rid of unnecessary expenses and allocate the savings towards debt reduction.

- Extra Payments: Whenever possible, make extra payments towards your debts. Even small additional payments can add up over time.

Negotiating with Creditors and Debt Settlement

If you’re facing financial challenges, negotiating with creditors can provide some relief. Here’s how to approach negotiations:

- Communicate Early: Contact your creditors immediately if you’re struggling to make payments. Explain your situation and try to work out what other options are available to you. Do not wait for you to start missing payments before giving them a call.

- Seek Temporary Relief: In cases of financial hardship, some creditors might offer temporary measures like reduced interest rates or lower minimum payments.

- Debt Settlement: If you’re unable to pay the full amount, you might be able to negotiate a settlement with your creditor. This involves paying a lump sum that’s less than the total debt.

- Get Agreements in Writing: Always get any agreements or settlements in writing before making payments.

Alternatives to High-Interest Debt

High-interest debt can hinder your financial progress. Exploring alternatives can help you manage debt more effectively:

- Balance Transfers: Some credit cards offer a lower APR. You might even find one that offers 0% interest. Consider transferring any credit card debt balance to that account.

- Consolidation Loans: For multiple high-interest debts, ask about consolidating them into a single loan with a lower interest rate. This will make repayment a bit easier on your pockets.

- Personal Loans: Look for companies that offer a personal loan with lower interest rates. Applying for one and paying off a high-interest credit card debt will help you save on interest payments and streamline your debt.

- Credit Counseling: Consider working with a reputable credit counseling agency. They can help you create a budget, negotiate with creditors, and develop a debt management plan.

Taking Control of Your Financial Future

Effective debt management requires discipline, determination, and a proactive approach to your financial well-being:

- Stay Committed: Stick to your debt repayment plan, even when it feels challenging. Consistency is key to success.

- Educate Yourself: Learn about personal finance, budgeting, and money management to make informed decisions.

- Avoid New Debt: While repaying existing debts, avoid taking on new debt that might derail your progress.

- Track Your Progress: Regularly review your debt reduction progress and celebrate your milestones.

By practicing these debt management techniques, you’ll not only be working towards credit repair, but you’ll also be building a solid foundation for your financial future.

In the next chapter, we’ll go over the importance of ongoing credit monitoring and provide insights into maintaining a healthy credit profile.

Next: Chapter 9: Maintaining Your Credit Health, where we explore the importance of ongoing credit monitoring and the steps you can take to ensure your credit remains in good standing. These will serve as a great guide as you continue on your credit repair journey.