So, you’ve reaped the benefits of being an authorized user. You’ve made your transactions and learned how to manage your credit responsibly. What’s next?

We have established that being an authorized user can be a valuable way to build credit. However, there may come a point when it’s advantageous to transition to managing your credit independently.

In this final chapter, we’ll discuss different reasons why you may want to remove yourself as an authorized user. We will also look into the steps to take to successfully remove yourself as an authorized user. Additionally, we will go over the potential impacts this action may have on your credit score. Finally, we will discuss what you can do to continue building your credit history.

How Long Should You Be an Authorized User?

Ideally, you should maintain an authorized user relationship for 1 to 2 years. After this time frame, it’s recommended to remove yourself as an authorized user, especially if your experience has been positive and you’ve built sufficient credit through alternative methods.

Continuing to be an authorized user beyond a year or two may not offer additional benefits to your credit score and could potentially expose you to risks related to the primary cardholder’s behavior.

When to Get Yourself Removed as an Authorized User

Deciding to stop being an authorized user on someone else’s credit card can be a difficult decision. Yes, entering into this type of arrangement can be good in terms of boosting your credit profile, but venturing out on your own could prove to be more beneficial in the long run. Additionally, if the arrangement is no longer benefitting you, it is wiser to detach yourself from it.

Here are several circumstances under which you might want to consider getting yourself removed as an authorized user on someone else’s credit card:

The Primary Account Holder’s Credit Usage Affects Your Score Negatively

If the primary cardholder’s financial behavior turned out to be less responsible financially than you initially believed, then it is best to terminate the arrangement before it can damage your credit health even more.

Another instance is if the account owner begins to mishandle their credit for any reason. If they start missing payments or utilize a higher percentage of the available credit, it is important to take prompt action.

Continuing as an authorized user under such circumstances could lead to a decline in your credit score. That’s because the actions of the primary account holder directly impact all authorized users.

You’ve Established Your Own Credit

Once you’ve established a good credit score and history on your own, relying on someone else’s credit card account becomes less necessary. At this point, building your credit independently through your financial activities will likely serve you better. You will be directly responsible for managing your account. Plus, you’ll be able to improve your credit score on your own terms.

Your Relationship with the Primary Cardholder Changes

Financial arrangements can get complicated if your relationship with the primary cardholder changes, especially if it’s due to personal reasons. For instance, if you’ve had a falling out with your friend or gone through a divorce with your spouse, managing a shared credit card account can add more stress to an already difficult situation.

You might need to take your name off the credit card, pay off any money you owe through the card, and maybe get a new credit card just for yourself. This helps make sure your money and credit score are safe and helps you start fresh, financially speaking, after your relationship changes.

Financial Goals and Habits Diverge

Your financial habits or goals may evolve differently from the primary account holder’s. If you become more conservative in your credit use or if you’re planning for a financial milestone that requires a pristine credit report, continuing as an authorized user on an account with high utilization or sporadic payments could hinder your plans.

The Account No Longer Serves Its Purpose

Sometimes, the account may no longer offer the benefits or rewards that once made it appealing. For example, suppose you initially became an authorized user to take advantage of the rewards offered by the account, but those perks are no longer available or have become less appealing. In that case, it may be time to detach yourself.

Additionally, if you’ve achieved your financial goals, such as securing a home loan or making a significant purchase, and no longer want the responsibility of maintaining a credit card account, you can terminate the arrangement after settling all financial obligations. In such cases, it’s important to evaluate the benefits and drawbacks of remaining an authorized user. Once you’ve done that, you can make a decision that aligns with your current financial needs and goals.

How to Get Yourself Removed as an Authorized User

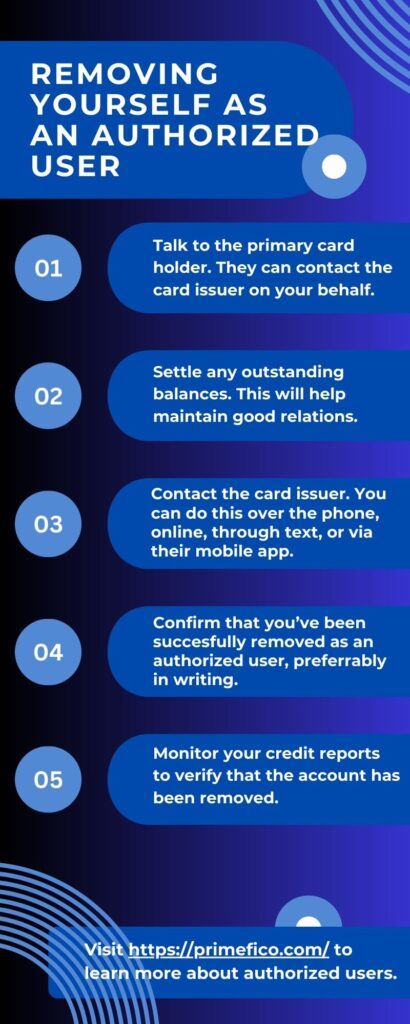

To get yourself removed as an authorized user, there are several steps you can follow:

- Contact the primary cardholder: It’s a good idea to discuss your decision with the primary cardholder and ask them to contact the card issuer to remove you as an authorized user. This is often the most straightforward approach. Additionally, it’s recommended to settle any outstanding balances or debts on the account before getting the arrangement terminated.

- Contact the card issuer: If the primary cardholder is unwilling or unable to contact the card issuer, you can contact the card issuer directly to request removal. Card issuers allow authorized users to request removal without the primary cardholder’s involvement. You’ll need to call the number on the back of the credit card and put in the removal request. Certain issuers may also offer alternative methods for removing an authorized user. You may contact them through their online or mobile app account management, text chat, or secure messaging with customer service.

- Follow-up: It’s important to confirm with the card issuer that you’ve been successfully removed as an authorized user.

- Monitor your credit reports: It’s recommended to check your credit reports for a few months after removal to ensure that the account drops off your credit report. If you still see the account reflected on your credit report months after removal, you may need to contact the card issuer or file a dispute with credit bureaus.

Before making a decision, it’s important to communicate with the primary account holder about your intentions. Discussing the situation openly can prevent misunderstandings and ensure a smooth transition. Additionally, review your credit report after being removed as an authorized user. Ensure that the account information has been updated correctly and that your credit score reflects your current credit activities accurately.

What’s Next After Being an Authorized User?

After being an authorized user, consider the following steps to continue building your credit history:

- Apply for a secured credit card: A secured credit card requires a cash deposit, which serves as your credit limit. This can help you build credit if you’re new to credit or have a limited credit history. You can also try for an unsecured credit card if you’ve managed to pull up your credit score sufficiently.

- Become an authorized user again: You should consider this if the negative experience is due to a non-ideal primary cardholder. You may have a better experience with a different primary cardholder.

- Apply for a credit-builder loan: A credit-builder loan is designed to help you build credit. The loan amount is held in a savings account while you make payments. You only receive the funds once the loan is paid off.

- Become a joint account holder: If you’re in a long-term relationship, consider becoming a joint account holder on a credit card with your partner.

- Monitor your credit report: Continue to monitor your credit report to ensure your credit history is being accurately reported.

By following these steps, you can continue to build your credit history and work towards financial independence.

Exiting an authorized user arrangement should be done thoughtfully, with an eye toward your personal financial health and goals. By carefully considering your situation and the points above, you can make an informed decision that best supports your long-term financial well-being.