If you’ve decided that a secured credit card is the right tool for your credit-building journey, choosing the right one is a critical next step. Secured credit cards are a valuable financial instrument for improving or establishing credit, provided you use them wisely. Once you’ve found the credit card that fits your needs, you’d need to go through the application process.

This section looks into selecting and applying for a secured credit card, setting you up for success in your credit improvement endeavors. From understanding eligibility requirements to evaluating different cards and navigating the application process, we’ll cover everything you need to know to make an informed decision.

Eligibility and Requirements for Secured Credit Card Application

Understanding the prerequisites for a secured credit card is crucial in ensuring you meet the specific criteria set by various issuers. These requirements not only reflect your eligibility but also prepare you for what to expect during the application process. Here’s a closer look:

Minimum Age

The general requirement for applying for a secured credit card is to be at least 18 years old. However, the age criteria can vary among different financial institutions.

Some banks like Wells Fargo and Discover have more flexible age requirements, allowing individuals under 18 to apply with a co-signer or joint account holder. Banks like Capital One and Citi may have stricter age restrictions and require applicants to be at least 18 years old without exceptions.

It’s advisable to check with the specific bank or issuer for their age eligibility criteria before applying for a secured credit card.

Income Considerations

Lenders are interested in your ability to repay borrowed amounts, which is why they consider your income during the application process.

You may be asked to provide recent pay stubs, bank statements, or tax returns as evidence of stable income. For self-employed applicants or freelancers, tax returns and bank statements are commonly requested to verify income.

Some issuers offer products specifically designed for students with limited income. These products might have lower income requirements but still require proof of financial stability. This could come in the form of scholarships, grants, or part-time employment.

Ability to Pay Security Deposit

The security deposit is a critical component of secured credit cards, acting as collateral for the credit issued. Institutions require their applicants to deposit this via bank transfer, credit card, or check. Some may allow you to pay via electronic funds transfer (EFT) or direct deposit from your bank account.

Creditworthiness

Secured credit cards are designed to be accessible, even to those with limited or damaged credit history. However, issuers may still review your credit history to determine eligibility.

For applicants with no credit history, the emphasis will be more on income stability and the ability to make the deposit.

For those with a poor credit history, issuers may assess recent financial activities more than past credit problems. This includes current debts, recent payments, and income stability.

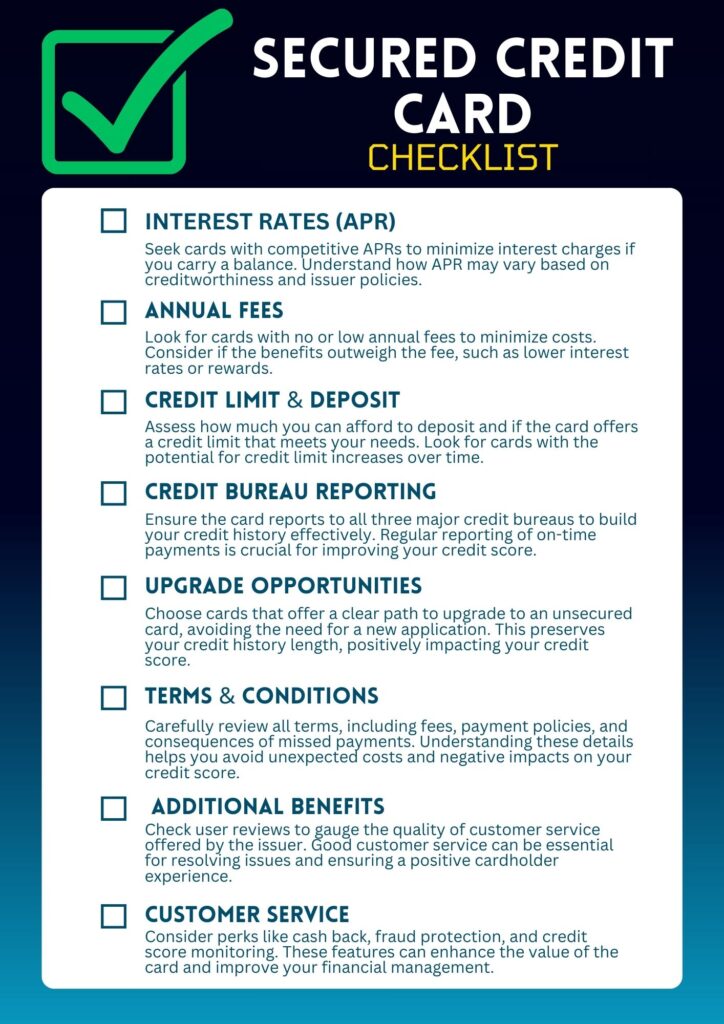

Choosing the Right Secured Credit Card

Selecting the right card is paramount. This decision will impact your financial journey, potentially affecting your credit score and overall financial health. Here’s what you need to consider to make an informed choice:

Annual Fees

Some secured credit cards charge annual fees, while others do not. Carefully compare the costs, as paying an annual fee might not be the best option if you’re trying to save money. However, a card with a small annual fee might offer benefits or a lower interest rate that could be advantageous for your credit-building efforts.

Interest Rates (APR)

While your goal should be to pay off your balance in full each month to avoid interest charges, understanding the card’s APR is important. Higher interest rates can quickly add up if you carry a balance, so look for cards with competitive rates. Remember, the APR can vary based on your creditworthiness and the card issuer’s policies.

Credit Limit and Security Deposit

The credit limit for most secured credit cards is typically equal to the security deposit you provide. Consider how much you can afford to deposit and how much credit limit you need for your monthly expenses.

Some cards may offer a higher credit limit than your deposit after a period of responsible use, which can be beneficial for your credit utilization ratio.

Credit Bureau Reporting

Ensure that the card issuer reports to all three major credit bureaus (Equifax, Experian, and TransUnion). Regular reporting of your on-time payments and responsible card use is crucial for building your credit score. Not all issuers report to all three bureaus, so this can significantly impact your credit-building efforts.

Upgrade Opportunities

Look for secured cards that offer a clear path to upgrading to an unsecured credit card. This feature is valuable because it means you won’t have to apply for a new card to transition to an unsecured card. Upgrading can also preserve the length of your credit history, which is a factor in your credit score.

Additional Benefits

While secured cards are typically basic, some offer benefits like cash back on purchases, fraud protection, and free access to your credit score. These perks can make using the card more rewarding and contribute to your financial management and credit monitoring strategies.

Customer Service and User Reviews

Good customer service can be crucial, especially if you encounter issues with your account. Look at user reviews of the card and issuer to gauge the quality of their customer service and the overall user experience.

Terms and Conditions

Carefully read the fine print to understand all terms and conditions, including fees, payment policies, and what happens if you miss a payment. Being well-informed can help you avoid unexpected costs or impacts on your credit score.

Choosing the right secured credit card involves balancing these factors based on your financial situation and credit-building goals. Take the time to research and compare options to find the card that offers the best combination of low fees, beneficial features, and growth opportunities.

How to Apply for a Secured Credit Card

Applying for a secured credit card is a straightforward process, but it requires careful preparation and attention to detail to enhance your chances of approval and to ensure the card meets your credit-building needs. Here’s a step-by-step guide on how to apply for a secured credit card:

Check Your Credit Score and Report

Before applying, it’s important to know your current credit standing. Obtain a free credit report from AnnualCreditReport.com and consider checking your credit score. This will help you understand which cards you’re more likely to qualify for and identify any credit issues that need addressing.

Research and Compare Secured Credit Cards

Not all secured credit cards are created equal. Spend time researching different cards, focusing on the factors discussed in the previous section, such as fees, APR, credit bureau reporting, and upgrade opportunities. Websites that compare credit cards can be a helpful resource.

Gather Necessary Documentation

Most applications will require your personal information (name, address, Social Security number), financial information (income, employment status), and possibly documentation to prove your identity or income. Having these documents ready can streamline the application process.

Apply Online or In-Person

Many secured credit card applications can be completed online, offering a quick and convenient way to apply. However, some banks and credit unions may allow or require you to apply in person, especially if you’re already a customer or if you’re using a secured card to establish a relationship with the institution.

Submit Your Security Deposit

If approved, you’ll need to submit your security deposit. The deposit amount will typically determine your credit limit. Most issuers allow you to transfer the deposit directly from a checking or savings account. Ensure you understand the minimum and maximum deposit amounts and how the deposit affects your credit limit.

Wait for Approval and Card Delivery

After submitting your application and deposit, there will be a processing period. If approved, your card and welcome materials will be mailed to you. This process can take a few weeks, so be patient.

Activate Your Card

Once received, follow the issuer’s instructions to activate your card. This may involve calling a phone number or activating the card online. Activation verifies that you’ve received the card and are ready to use it.

Secured Credit Cards You Can Look Into

Here are four examples of secured credit cards that could pave your path to financial empowerment:

Self Visa Credit Card

The Visa Credit Card from Self.inc blends the benefits of a credit-builder loan with a secured credit card. It is tailored for individuals with less-than-ideal credit histories. To be eligible, applicants must maintain an active Credit Builder Account in good standing, achieve a minimum of three punctual payments, and accumulate at least $100 after deductions for interest and fees, all while adhering to certain income prerequisites.

You can transition to the Visa Credit Card without extra deposits after consistent on-time payments. Users can enjoy a credit limit between $100 and $3,000, determined by their security deposit. Note that there is an annual fee of $25 for the Self Visa Credit Card, in addition to administrative fees for opening the Credit Builder Account.

Grow Credit

The Grow Visa Preferred Secured Credit Card stands out as an invaluable resource for individuals aiming to rebuild or enhance their credit history. It works simply: you put down a deposit into a savings account, and that amount becomes your credit limit. Just like most credit cards, the Grow Visa Secured Credit Card reports all payment activities to the three major credit bureaus.

Remarkably, there are no yearly fees to worry about, no interest costs, and applying does not require a hard inquiry. Additionally, consistent on-time payments can qualify you to transition to an unsecured credit card.

Capital One Secured Mastercard

The Capital One Secured Mastercard is a practical choice for those aiming to build or improve their credit score. It requires a refundable security deposit starting as low as $49, which is excellent for applicants with limited upfront cash. And depending on your creditworthiness, you may qualify for a credit line of up to $200. This card also offers a pathway to a higher credit line after just six on-time monthly payments, without needing an additional deposit. Moreover, with no annual fee, it’s a cost-effective tool for credit building. Capital One also provides free access to CreditWise, helping you monitor your credit score and understand how to improve it.

Discover it® Secured Credit Card

The Discover it® Secured Credit Card is another great choice for people wanting to build or fix their credit. You start with a minimum of $200 security deposit, which sets your credit limit. This card rewards you with 2% cash back at gas stations and restaurants on up to $1,000 of spending each quarter. It’s accessible because it has no annual fee.

After using the card responsibly for seven months, Discover will review your account to see if they can upgrade you to an unsecured card. If yes, you’ll get your deposit back. This card helps improve your credit since Discover reports your activity to the credit bureaus. You can also pay your deposit and bills through money transfers or money orders.

Ready to Build with a Secured Credit Card?

In the next section, we will dive into the nuances of managing your secured credit card effectively. We’ll cover the common pitfalls to avoid and provide essential strategies for leveraging your card to build or enhance your credit profile. This includes tips on optimal credit utilization, timely payment practices, and monitoring your credit score’s progress. Our goal is to empower you with the knowledge needed to use your secured credit card as a powerful tool in your credit-building journey.